Income Tax Calculator 2024-25 Excel

import Image from "next/image";

Income Tax Calculator 2024-25 Excel: Comprehensive Guide & Free Download

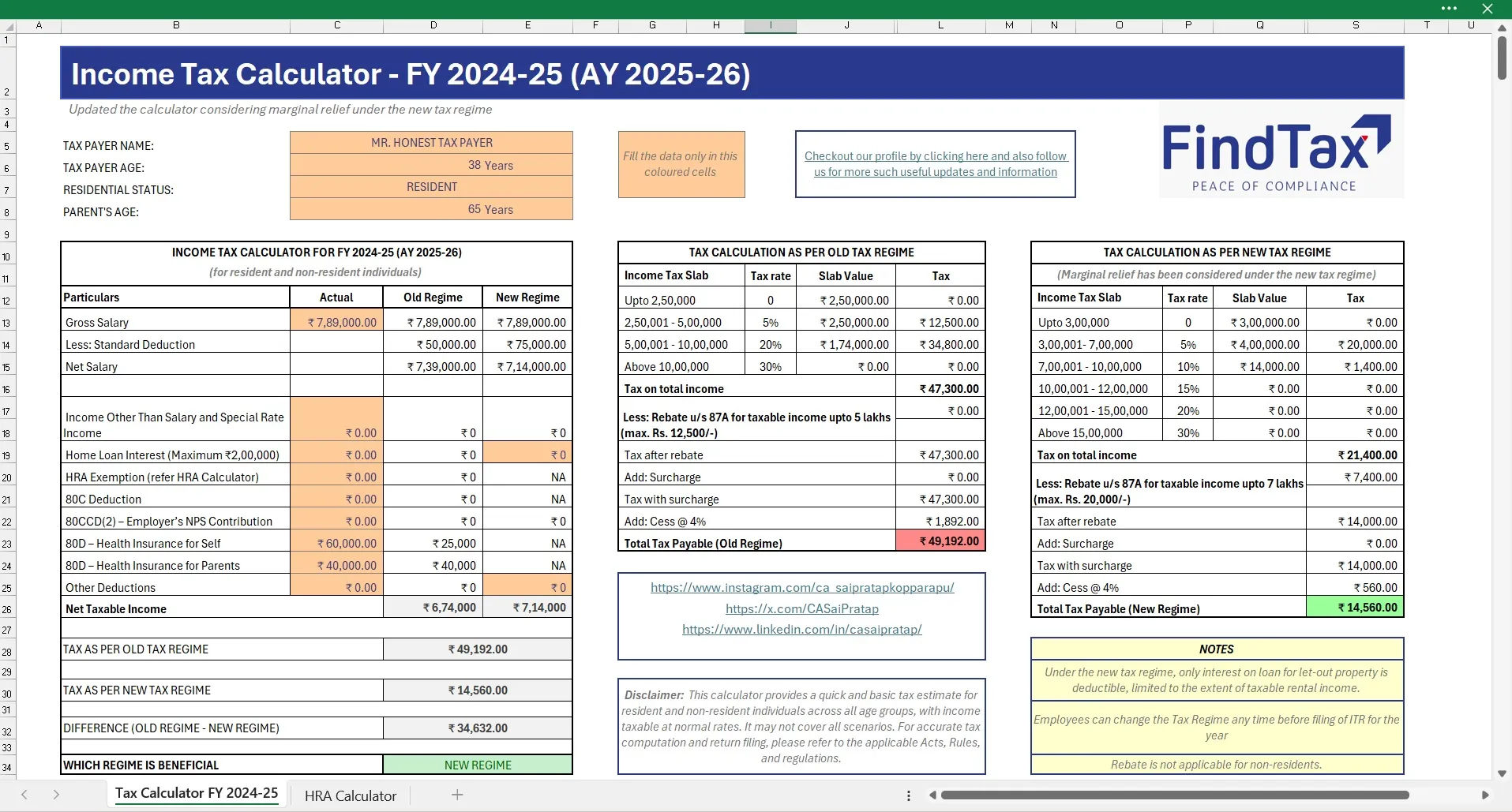

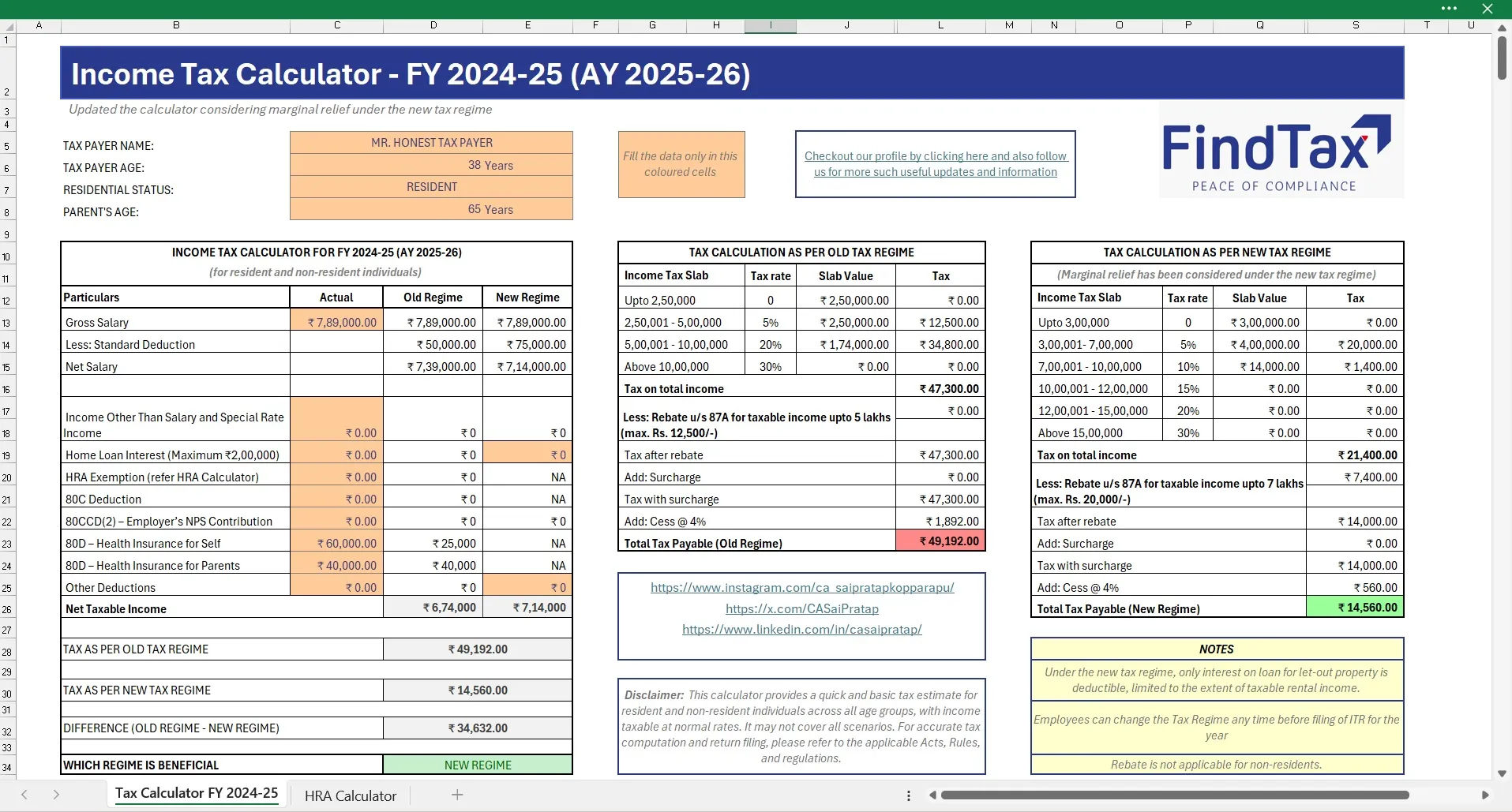

Welcome to your definitive resource on the Income Tax Calculator 2024-25 Excel tool, designed to assist taxpayers in India with accurate tax calculations for the Financial Year (FY) 2024-25 and Assessment Year (AY) 2025-26. This page covers everything you need to know about income tax filing in India in 2025, including an overview of the income tax system, detailed insights into the new and old tax regimes, key tax slabs, and an easy-to-use Excel calculator. Whether you are a salaried individual or a taxpayer seeking a user-friendly tax planning tool, this guide and downloadable Excel will simplify your income tax return process.

Introduction to Income Tax Filing India 2025

The income tax filing India 2025 season brings important updates and changes relevant for taxpayers under the Indian Income Tax Department regulations. In FY 2024-25, taxpayers must calculate their tax liabilities accurately to file returns and comply with legal requirements.

Filing accurate income tax returns is crucial for salaried individuals, self-employed professionals, and other taxpayers across India. Timely filing helps avoid penalties and enables smooth processing of refunds if applicable.

Income Tax Calculator AY 2024-25 Excel TaxGuru Overview

The Income Tax Calculator AY 2024-25 Excel TaxGuru inspired tool is a free, Excel-based solution combining the new and old tax regimes into a single, easy-to-use interface. Designed specifically for Indian taxpayers, it automates complex calculations and helps you visualize your tax liability under both regimes to make an informed choice.

Key Benefits:

- Calculates tax under both new and old regimes simultaneously

- Helps taxpayers choose the most tax-efficient option

- Suitable primarily for salaried taxpayers and pensioners

- Simple input cells for income, deductions, and exemptions

- Password-protected formulas to maintain integrity and accuracy

- Supports quick, hassle-free tax planning before filing returns

This Excel tool is widely recommended on tax forums and by financial advisors as reliable and comprehensive for personal tax calculations.

New vs Old Tax Regimes

Understanding the difference between the two tax regimes is essential when using the income tax calculator 2024-25 excel or filing your tax returns.

| Feature | New Tax Regime | Old Tax Regime |

|---|---|---|

| Default Regime since FY 2023-24 | Yes | Optional |

| Number of Tax Slabs | Expanded with lower rates | Classic slabs, fewer brackets |

| Exemptions & Deductions | Mostly removed | Large list of exemptions allowed |

| Standard Deduction | ₹75,000 | ₹75,000 |

| Rebate U/S 87A | ₹25,000 for income ≤ ₹7.5 lakh | ₹12,500 for income ≤ ₹7.5 lakh |

| Investment Incentives | Discouraged | Encouraged through Section 80C deducsions |

Important Tax Slabs and Deductions for FY 2024-25

New Tax Regime Slabs FY 2024-25 (AY 2025-26)

| Net Income (₹) | Tax Rate |

|---|---|

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 to ₹7,00,000 | 5% |

| ₹7,00,001 to ₹10,00,000 | 10% |

| ₹10,00,001 to ₹12,00,000 | 15% |

| ₹12,00,001 to ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

Old Tax Regime Slabs FY 2024-25

| Age Group | Income Range (₹) | Tax Rate |

|---|---|---|

| Below 60 years | Up to ₹2,50,000 | Nil |

| ₹2,50,001 to ₹5,00,000 | 5% | |

| ₹5,00,001 to ₹10,00,000 | 20% | |

| Above ₹10,00,000 | 30% | |

| Senior Citizens (60-80 yrs) | Up to ₹3,00,000 | Nil |

| Super Senior Citizens (>80) | Up to ₹5,00,000 | Nil |

Key Concepts Related to Income Tax Department Procedures

- Income Tax Return (ITR): Filing your tax return accurately with the Income Tax Department is mandatory for individuals above the exemption limit.

- Chapter VI-A Deductions: Sections like 80C, 80D provide tax benefits on investments and specified expenses.

- Tax Rebate under Section 87A: Possible rebate for eligible taxpayers to reduce tax liability.

- Standard Deduction: A fixed deduction under both regimes to lessen tax burden for salaried individuals.

- Advance Tax & TDS: Mechanisms by which tax is paid during the year or deducted at source by employers.

How to Use the Income Tax Calculator 2024-25 Excel

The income tax calculator 2024-25 excel provides an intuitive interface:

- Download the Excel sheet from the links below.

- Open the calculator and review the instructions on the first sheet.

- Enter your total income from all sources such as salary, interest, rental income, etc.

- Fill in deductions and exemptions applicable under Chapter VI-A including investment claims.

- Check the summary tab where tax liabilities under both the new and old tax regimes are calculated automatically.

- Compare the results to identify the most beneficial tax regime.

- Save and use this for your income tax return filing purposes.

Always ensure you only enter data into the highlighted input fields to avoid corrupting formulas.

Download the Income Tax Calculator 2024-25 Excel

You can download the Income Tax Calculator 2024-25 Excel tool from the following trusted sources:

This free downloads help simplify your tax filing process and assist you in making informed decisions on tax planning.

FAQs and Additional Resources

Frequently Asked Questions

Q: Can this Income Tax Calculator Excel be used for long-term capital gains?

A: No. This calculator primarily assists with salary and ordinary income tax calculations.

Q: Is the new tax regime mandatory?

A: The new tax regime is the default, but you can opt to continue with the old regime by filing the appropriate declarations.

Q: How accurate is this calculator for income tax filing India 2025?

A: It provides an accurate estimate based on current laws but always verify with official filings and consult professionals if needed.

Useful Resources

- Official Income Tax Department Tax Calculators

- Online ClearTax Income Tax Calculator

- Latest Budget 2024 Updates

Conclusion

The Income Tax Calculator 2024-25 Excel is your essential tool for navigating Indian tax laws and efficiently preparing your income tax return. By leveraging this calculator, taxpayers can avoid costly mistakes, optimize tax payments, and ensure timely filing with the income tax department.

This page combines detailed tax insights, authoritative information, and practical tools to empower you for the 2024-25 income tax filing India season.

Content compiled from verified tax portals including ArthikDisha, TaxGuru, FindTax.in, and the Income Tax Department of India to ensure accuracy and trustworthy guidance.